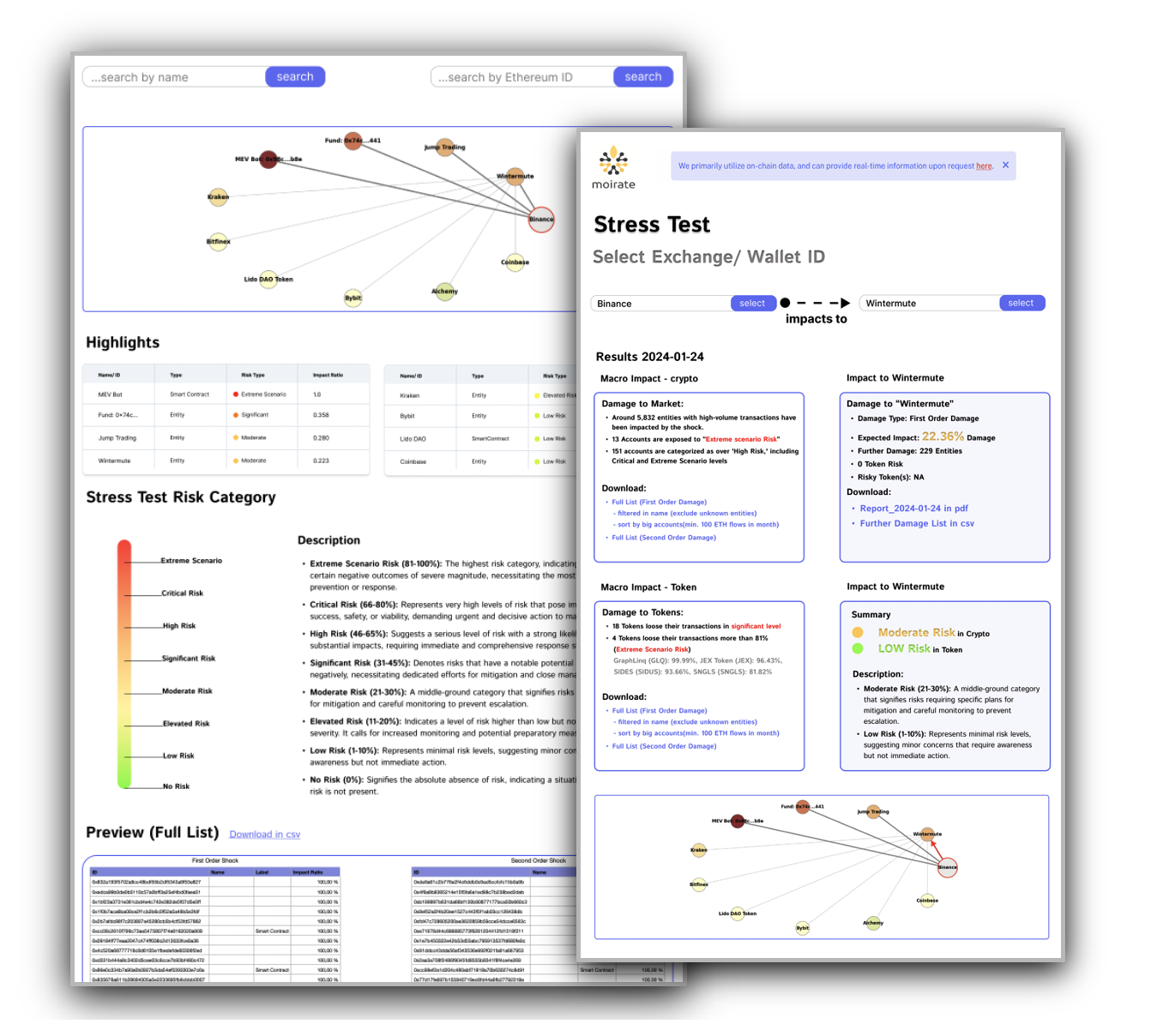

Stress Test - Example

Request Trial

Our algorithm is a sophisticated stress testing tool designed to simulate crash scenarios of specific

actors within a financial ecosystem. By modeling the failure of a selected entity, the software calculates

the cascading impacts on other stakeholders, assets, and the broader market. This enables users to assess

their counterparty risk comprehensively.

The stress test is an invaluable tool for risk managers, financial analysts, and stakeholders,

providing a clear understanding of potential vulnerabilities and aiding in the development of strategies

to fortify financial resilience.

Note: The results are derived from on-chain data exclusively and do not account for

off-chain activities.

Key features include:

1. Simulation of Crash Scenarios: Users can select an actor of interest and simulate a

complete failure, analyzing the immediate and extended effects on the ecosystem.

2. Impact Analysis: The software identifies all stakeholders and assets affected by the

simulated crash, providing a detailed list of impacted entities and tokens.

3. Secondary and Tertiary Damage Assessment: It examines both direct and indirect

consequences, detailing secondary and tertiary damages to offer a complete picture of the fallout.

4. Total Damage Quantification: The tool quantifies the overall financial impact, aggregating

losses across various categories to present a holistic damage assessment.

5. Mitigation Insights: Equipped with advanced analytics, the software offers critical

insights and recommendations for designing robust mitigation strategies. These insights help users minimize

counterparty risks and enhance their risk management frameworks.