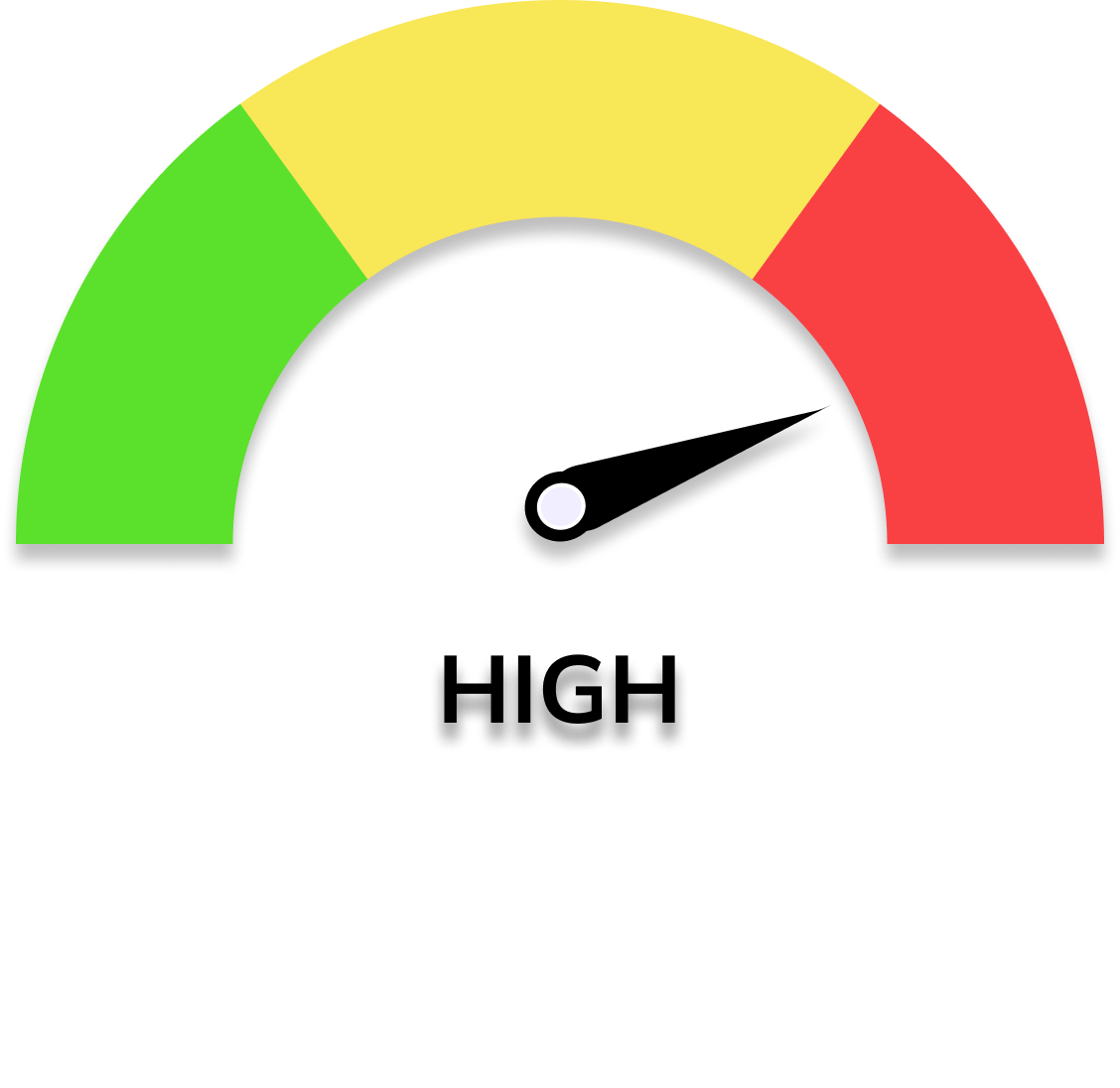

Manipulatable Market Index (MMI)

The data is updated hourly

[2026-01-09 13:10:00 UTC]

- Low: In this category,

there's more trading activity than usual.

This typically means the asset might be less affected by sudden changes in market prices and tends

to follow the general market trend.

- Medium:

Here, trading activity is at a normal level, which often indicates a balanced market.

It's possible that the market is not overly sensitive to sudden price shifts,

maintaining a certain level of steadiness.

- High: In this category,

trading activity is lower than usual. This could make the asset more vulnerable to sudden changes

in market prices. Small financial movements might lead to significant shifts in prices.

This index offers insights into how manipulatable the market is in response to

asset

flow, utilizing data from 12 different market observations.

(Keep in mind, it does not provide information regarding market direction)

Details

[Green - Low (manipulatable);

Gray - Average;

Red - High]

Parameter P1~P4: Ether Market Activity Indicators

Parameter P5~P8: WETH Market Activity Indicators

Parameter P9~P12: Liquidity Provision Activity Indicators

Consideration:

- Remove Seasonality: Subtract seasonal data to highlight underlying

trends.

-Detrend: Eliminate long-term trends to focus on short-term anomalies.

-Include External Factors: Add relevant outside variables to refine

detection.

-Smooth Noise: Apply filters to clarify true anomalies.

-Apply Statistics: Use tests to flag significant deviations as anomalies.

The data is updated hourly

Daily seasonality is considered in this parameter set.

Only abnormal activities

are caught!